utah county sales tax calculator

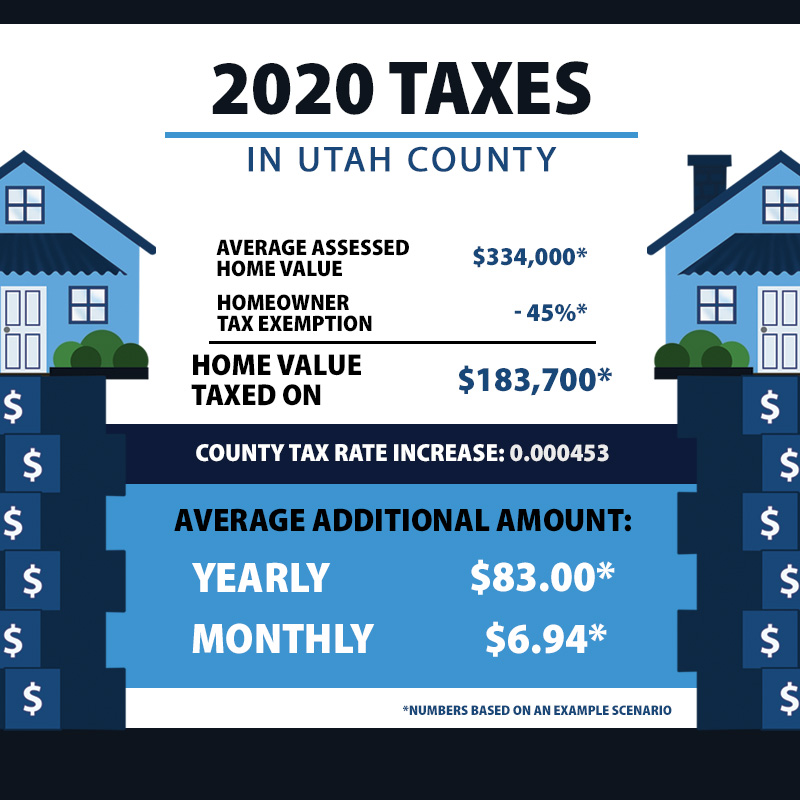

Homeowners in Utah also pay exceptionally low property taxes with an average effective rate. This includes the rates on the state county city and special levels.

The Benton County Washington Local Sales Tax Rate Is A Minimum Of 6 5

Rates vary from city to city.

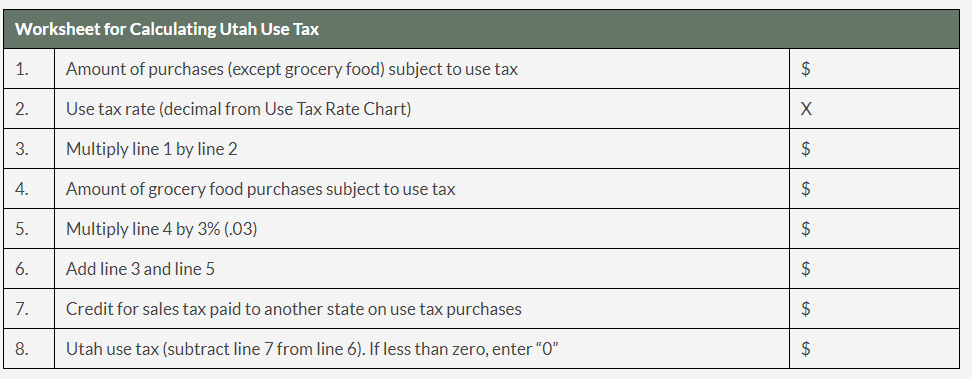

. If you need access to a database of all Utah local sales tax. Note that sales tax. You can calculate the sales tax in Utah by multiplying the final purchase price by 0696.

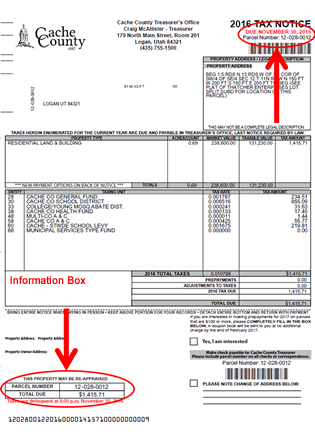

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 715 in Uinta County Utah. The average cumulative sales tax rate in Cache County Utah is 689 with a range that spans from 67 to 7. Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates.

Multiply the rate by the purchase price to calculate the sales tax amount. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. The Clark County Nevada sales tax is 825 consisting of 460 Nevada state sales tax and 365 Clark County local sales taxesThe local sales tax consists of a 365.

The current total local sales tax rate in Utah County UT is 7150. Sales taxes in Utah range from 610 to 905 depending on local rates. The average cumulative sales tax rate in Salt Lake County Utah is 761 with a range that spans from 725 to 875.

Average Local State Sales Tax. Use our simple sales tax calculator to work out how much sales tax you should charge your clients. 93 rows General Information.

Input the amount and the sales tax rate select whether to include or exclude sales tax. S Utah State Sales Tax Rate 595 c County Sales Tax Rate l Local Sales. Click any locality for a full breakdown of local property taxes or visit our Utah sales tax calculator to lookup local rates by zip code.

All numbers are rounded in the normal fashion. Tax rates are also available online at Utah Sales Use Tax Rates or you can. Download state rate tables.

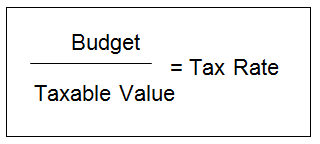

Sales Tax Rate s c l sr Where. 271 rows Average Sales Tax With Local6964. This includes the rates on the state county city and special levels.

The December 2020 total local sales tax rate was also 7150. Just enter the five-digit zip code of the. How to Calculate Utah Sales Tax on a Car.

For example lets say that you want to. This includes the rates on the state county city and special levels. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a.

See Utah Sales Use Tax Rates to find your local sales tax rate. Sales Tax in Utah County Utah is calculated using the following formula. This page lists the various sales use tax rates effective.

The average cumulative sales tax rate in Weber County Utah is 727 with a range that spans from 725 to 745. There are a total of 127. The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates andor.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

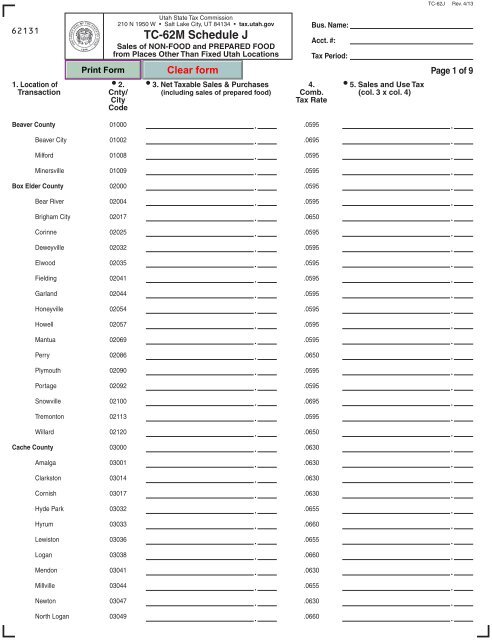

Tc 62m Schedule J Utah State Tax Commission Utah Gov

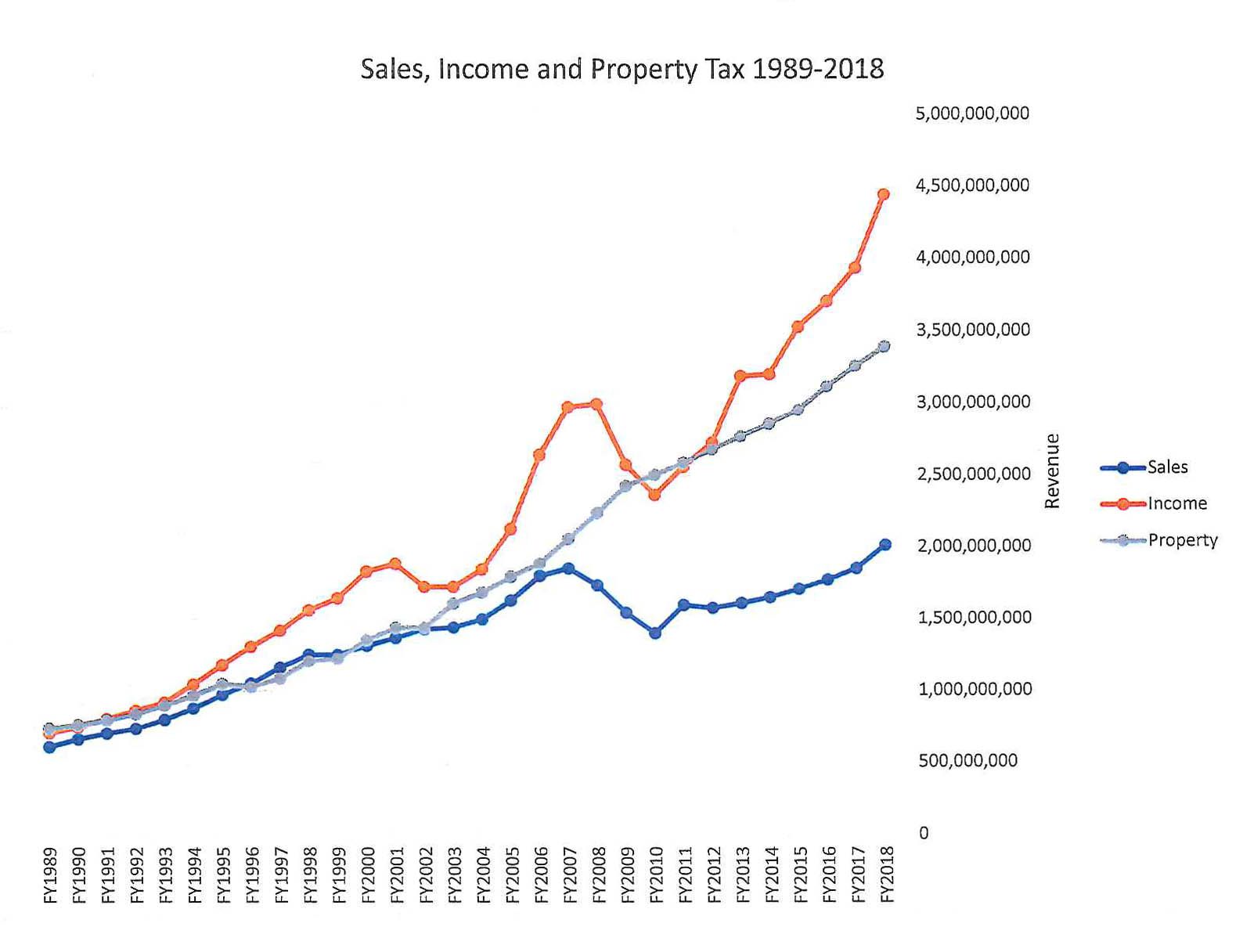

Historical Utah Tax Policy Information Ballotpedia

Sales Tax Laws By State Ultimate Guide For Business Owners

How Property Tax Works In Utah

Utah Sales Tax Guide And Calculator 2022 Taxjar

Local Sales Tax Rates Tax Policy Center

State And Local Sales Tax Calculator

Hennepin County Mn Property Tax Calculator Smartasset

Us Sales Tax For Online Sellers The Essential Guide Webretailer Com

Truth In Taxation Summit County Ut Official Website

Property Taxes In Nevada Guinn Center For Policy Priorities

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Official Site Of Cache County Utah Paying Property Taxes